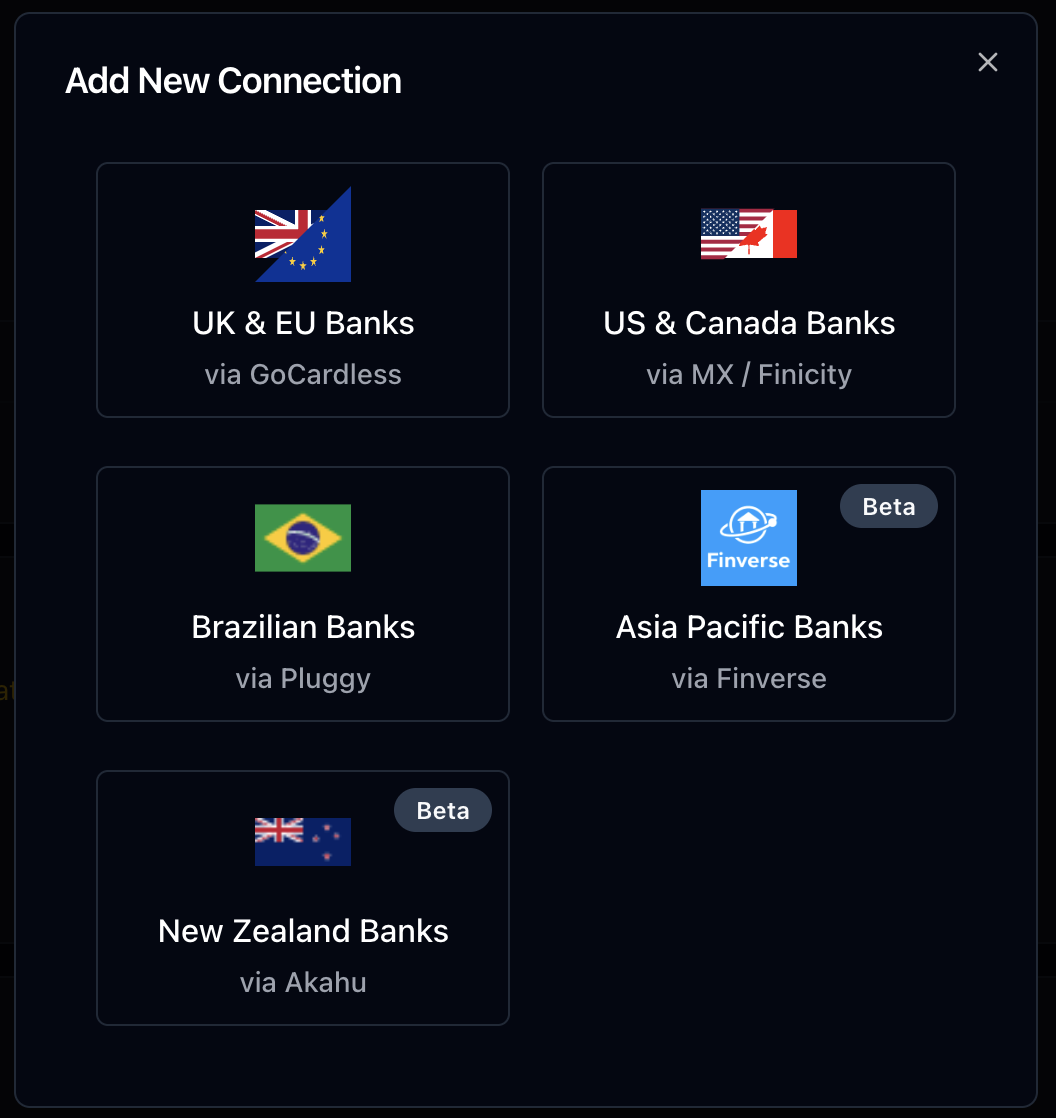

How to Connect

Go to

the connections page

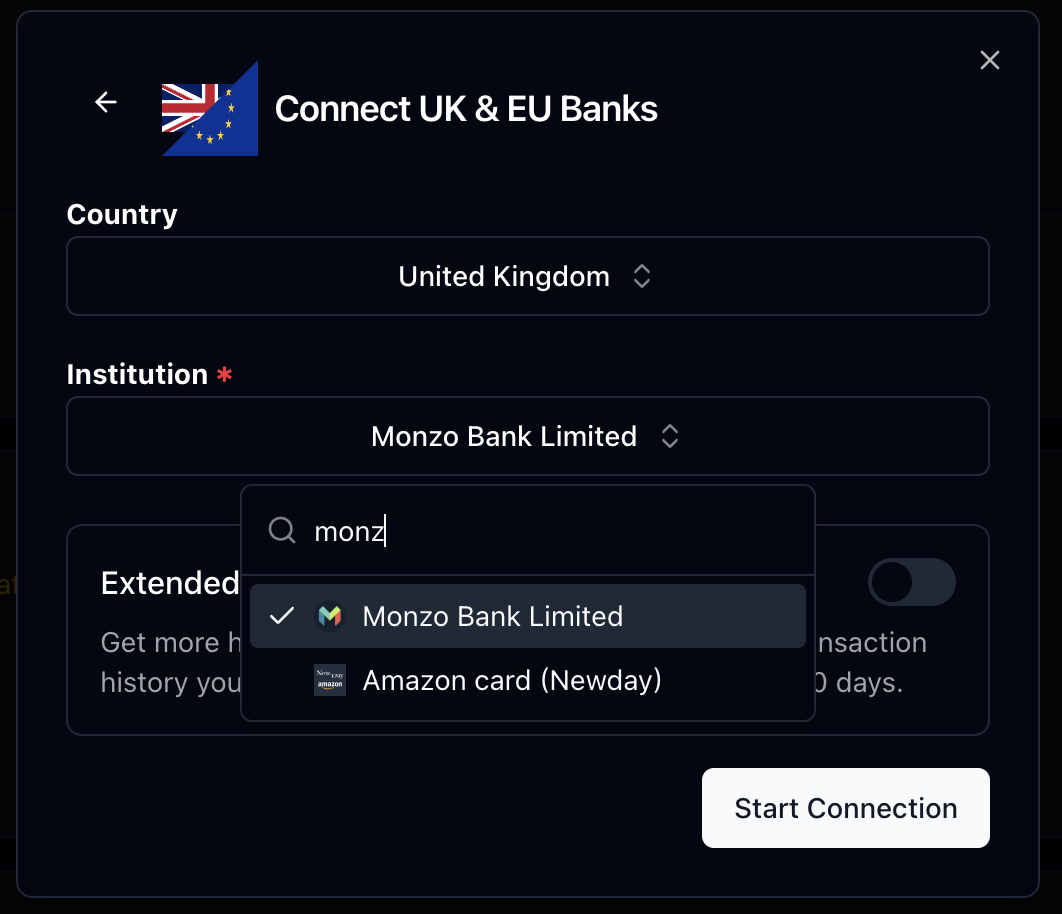

[Optional] Toggle “Extended Transaction History” to get more historical data by requesting the maximum transaction history your bank allows. By default, we fetch the last 90 days.

Connection Renewal

Due to PSD2 regulations, GoCardless connections are only valid for 90 days, and then you’ll need to renew access to your bank. You’ll receive an email reminder before your connection expires. To renew your connection, simply head over to the connections page and click the ‘renew access’ button on the connection you’d like to renew, then follow the prompts to reconnect (which would look quite similar to the initial connection flow). Once you’re done, you’ll be redirected back to Lunch Flow. If Lunch Flow is able to match up all accounts from the new connection, then you’ll simply see your connection marked as ‘active’ again. If not, you’ll see a screen where you can manually map accounts from the new connection to the old ones.Reviewing Bank Data

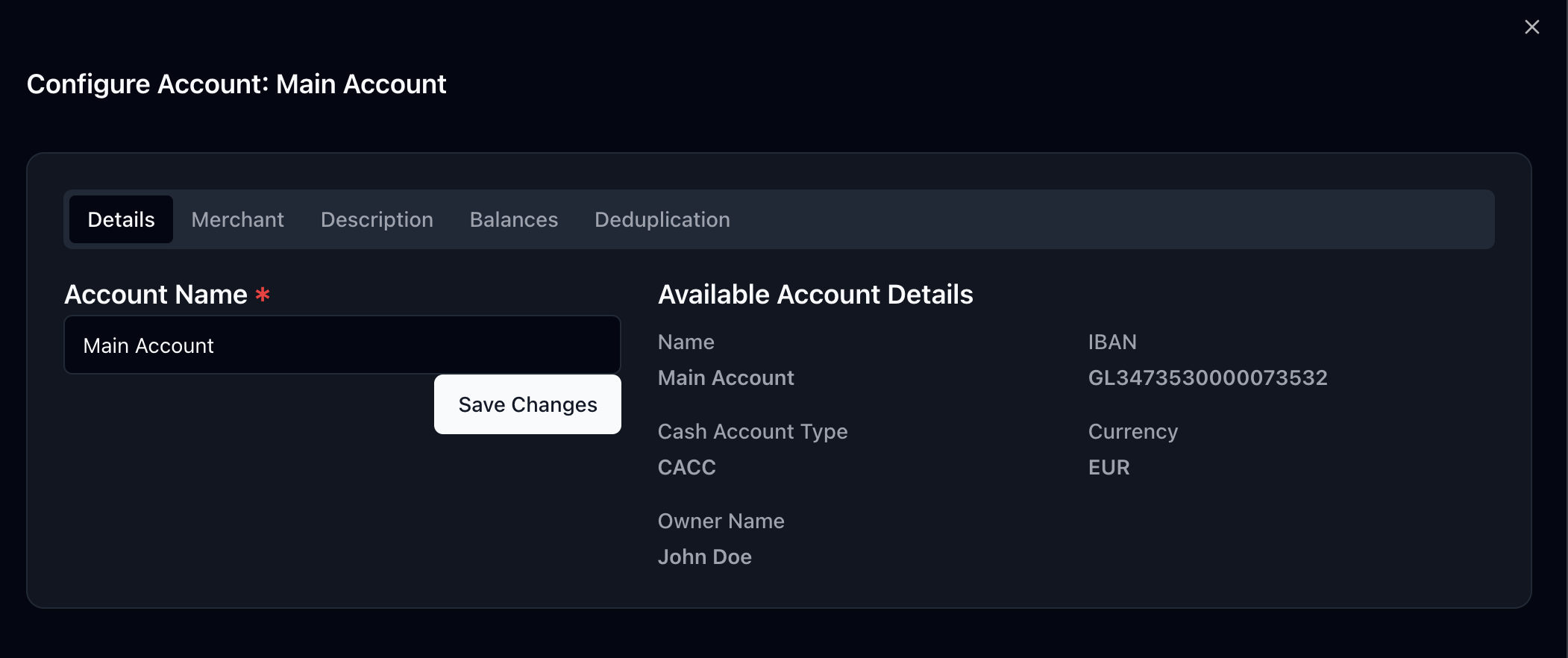

While open banking is standardized in the UK & EU, there’s still a lot of variation in the available transaction and balances data available from each bank. It’s always a good idea to review the acounts imported from your bank to ensure they’re correct.Account Names

The first thing you’ll want to check is the account name. Lunch Flow will attempt to infer the account name from the account details, but it’s always a good idea to review it to ensure it’s correct. and you can easily change it if needed.

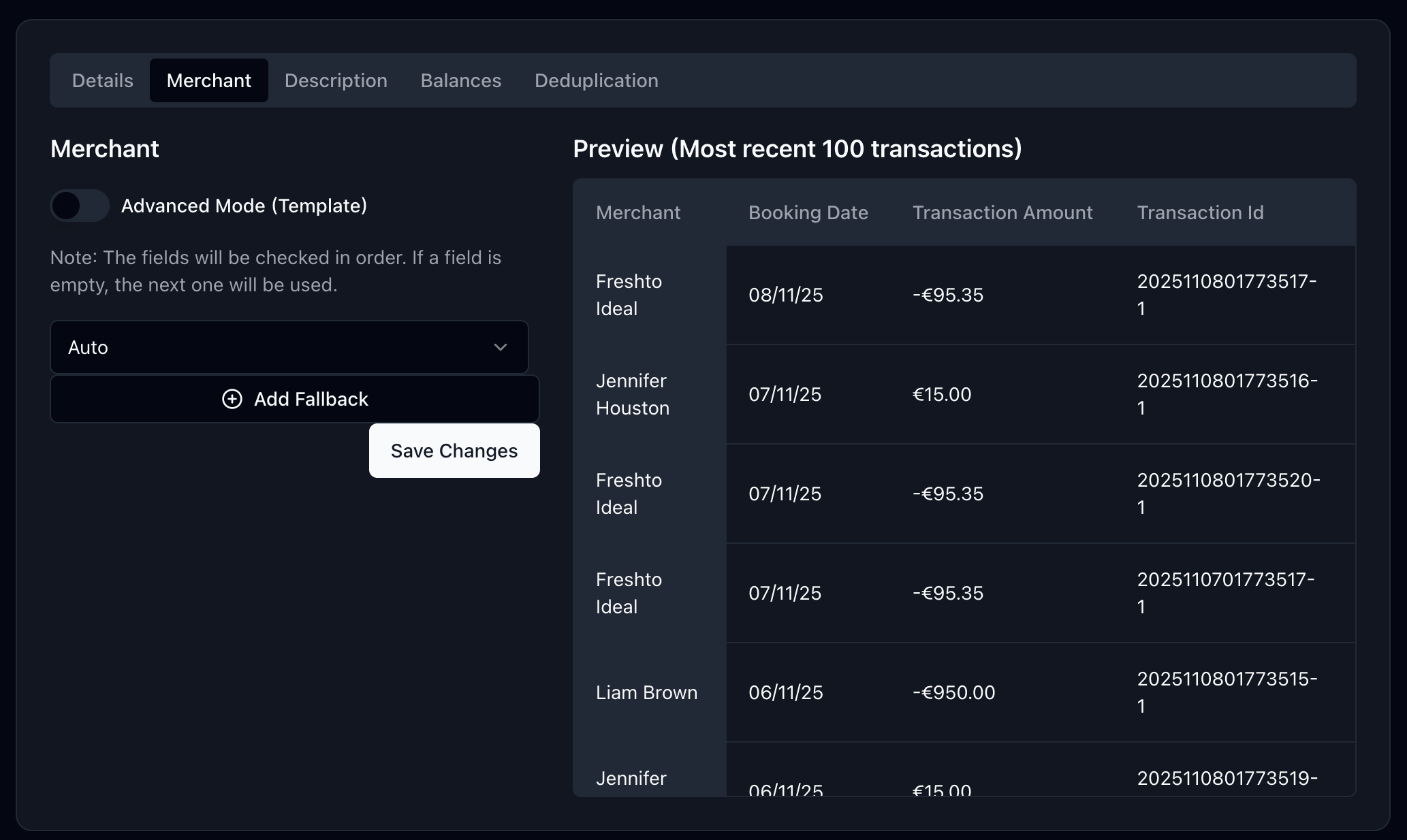

Transaction Descriptions & Merchant Names

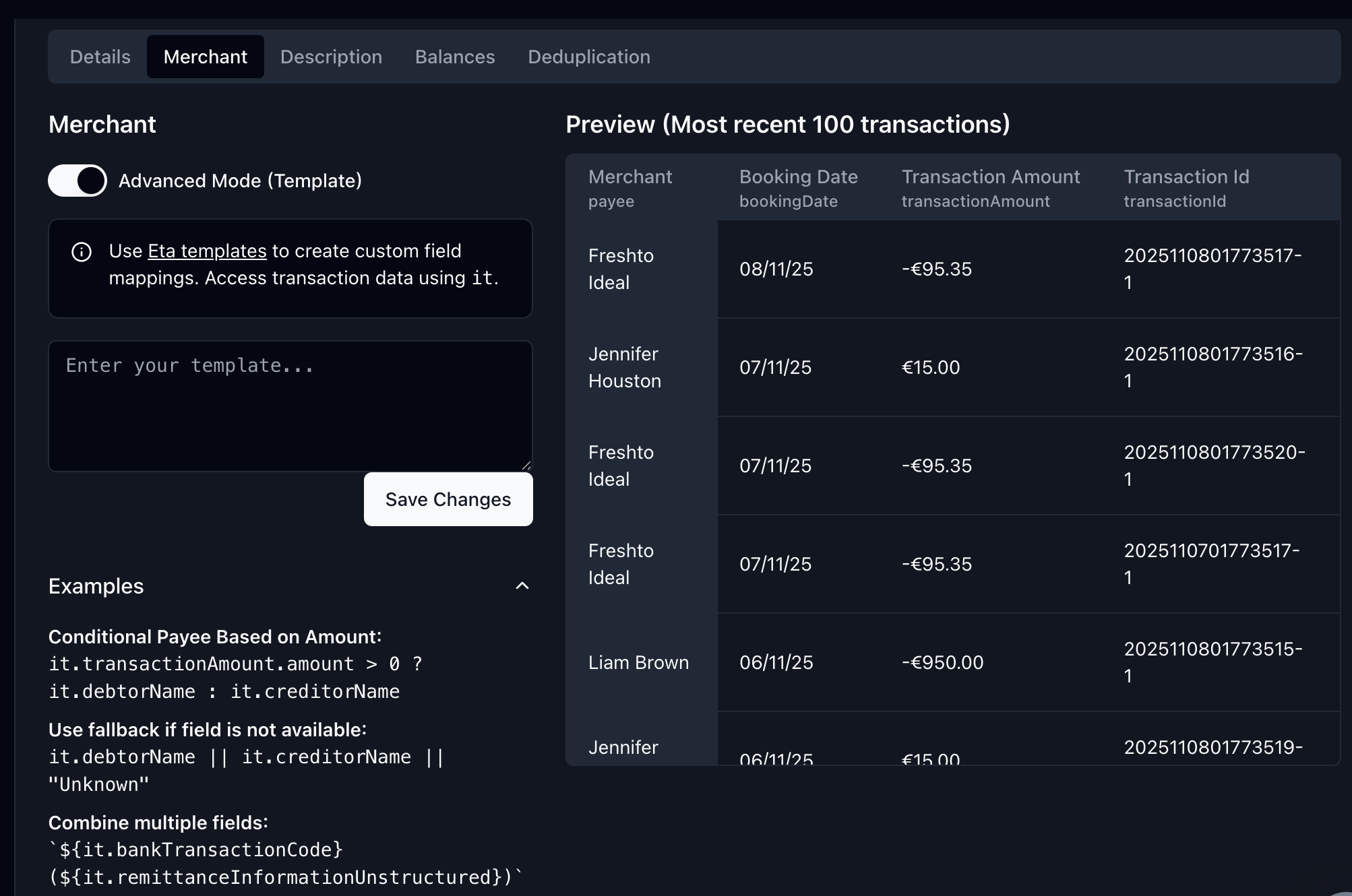

The next thing you’ll want to check is the transaction descriptions and merchant names. GoCardless returns a lot of optional data for each transaction, and each bank can return the data in a slightly different format. Lunch Flow will attempt to infer the transaction description and merchant name from the data returned by the bank (This is theAuto setting) but you can always configure which fields you’d like to use.

Advanced mode that allows you to write a custom template to parse the transaction data using Eta templates. You’ll find plenty of examples in the template editor, along with a live preview of the template in action.

Tip: you can also use ChatGPT to have it auto generate a template for you 😀

Balances

Finally, you’ll want to check the balances. GoCardless potentially returns multiple balances for each account, so you can configure which balance you’d like to use for syncing with your destinations.

FAQ

My bank isn’t listed. Can you add it?

We’re constantly expanding coverage, you can:- Email us with your bank details and we’ll investigate.

- It’d be very helpful if you can also share other providers or apps that already integrate with your bank (if any).

Why are my savings, investments, pension, or credit card accounts not showing?

Lunch Flow relies on open banking (PSD2) through GoCardless, which unfortunately doesn’t cover all types of financial accounts—only current payment accounts. For example, savings accounts, investments, pensions, and even credit cards are not always covered since they’re considered “non-payment” accounts.Some banks don’t consider credit cards as ‘payment’ accounts, so they don’t share this data through the API … I know 🤷♂️What you can do:

- Reach out via email to ask for a specific institution - we can check if it’s available.

- If you know a way to pull data from that institution (API docs, other aggregators, or apps that offer data), feel free to share

Do you integrate with Swiss Banks?

Switzerland has special requirements. See our dedicated Swiss banks guide for details.Security & Privacy

How It Works

- You log in directly to your bank (not to Lunch Flow)

- Bank authorizes read-only access (PSD2 standard)

- GoCardless fetches transaction data securely

- Lunch Flow receives normalized data

- We store encrypted data (AES-256)

What We Can’t Do

- ❌ See your bank login credentials

- ❌ Make transfers or payments

- ❌ Access full account numbers (only last 4 digits)

- ❌ View PINs or security answers